Are you thinking of buying property in Bangalore to earn rental income? Smart move—but here’s the thing: NOT all localities give you the same returns.

Some areas will get you 3% annual rental yield. Others? 6-7%. That’s literally DOUBLE the return on the same investment amount.

And if you pick the wrong locality, you could end up with a property that’s vacant for months, tenants who leave after 6 months, or worse—negative cash flow.

This guide breaks down exactly which Bangalore localities give you the best rental ROI in 2026, how to calculate your returns, and what mistakes to avoid so your money works harder for you.

Whether you’re an NRI looking for passive income, a first-time investor, or someone building a rental portfolio—this is your complete investment playbook.

Let’s dive in.

Why Bangalore is India’s #1 City for Rental Investment (2026 Reality Check)

Before we get into specific localities, let’s talk about why Bangalore continues to dominate rental investment discussions.

The Numbers Don’t Lie

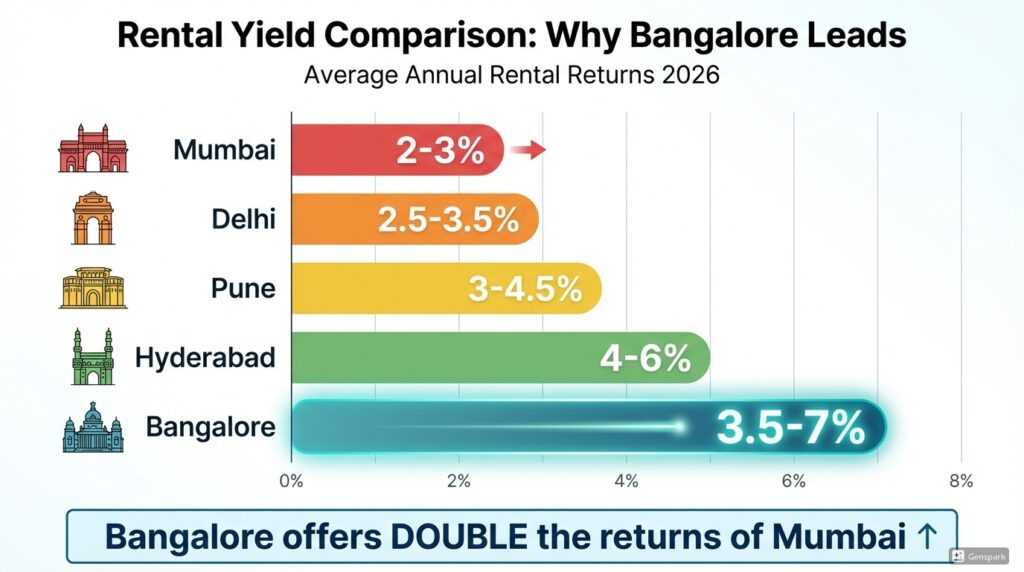

Average rental yield in Bangalore ranges from 3.5-7% depending on location. According to Reserve Bank of India’s housing market reports, rental yields in major metros have remained stable with Bangalore offering competitive returns.

Compare this to other metros: Mumbai delivers just 2-3% (expensive properties, lower yields), Delhi gives 2.5-3.5%, Pune ranges 3-4.5%, and Hyderabad sits at 4-6%. Bangalore consistently outperforms because of one simple reason: massive tenant demand with relatively affordable property prices.

What’s Driving This Demand?

The IT sector continues to be Bangalore’s biggest rental demand driver, and it’s not slowing down anytime soon. We’re talking about 2.1 million people employed in Karnataka’s software industry, with the majority based in Bangalore. Every quarter, new Global Capability Centers open their doors. Work-from-office mandates are bringing employees back to the city after the remote work experiment. Startups are hiring aggressively despite market uncertainties. The bottom line? As long as IT thrives, Bangalore rentals thrive.

Then there’s the sheer population momentum. Bangalore currently has 14.4 million residents, and projections show it hitting 20 million by 2030. That’s 400,000 to 500,000 new residents every single year—all of them needing a place to live. The average age in Bangalore is just 28 years, and these young professionals overwhelmingly prefer renting over buying, at least for the first 5-7 years of their career.

Infrastructure development is accelerating too. Namma Metro’s Phase 2 and 3 are underway (BMRCL official site), the Peripheral Ring Road is being planned by BDA (Bangalore Development Authority), new tech parks are coming up along the ORR and beyond, and airport connectivity keeps improving. According to the Ministry of Housing and Urban Affairs, Bangalore ranks among the top 5 cities in India for rental housing demand, driven by IT sector growth and urbanization.

What does all this mean for investors? Consistent tenant demand, vacancy rates that stay low, and predictable rent escalation of 5-10% every year.

Understanding Rental Yield: The Math That Actually Matters

Before we talk localities, you NEED to understand this calculation. It’s the single most important metric for rental investment.

Gross Rental Yield Formula

Gross Rental Yield (%) = (Annual Rental Income ÷ Property Purchase Price) × 100

Let’s say you buy a property for ₹50 lakhs and rent it out for ₹20,000 per month. Your annual rent is ₹2.4 lakhs. Plug that into the formula: (₹2,40,000 ÷ ₹50,00,000) × 100 = 4.8% gross yield. Simple enough.

Net Rental Yield (The REAL Number)

Gross yield doesn’t account for expenses, and that’s where most investors get the math wrong. Here’s what you actually take home after all costs:

Net Rental Yield = [(Annual Rent - Annual Expenses) ÷ Total Investment] × 100

Your annual expenses will typically include property tax (₹8,000-₹15,000 per year, payable at BBMP Property Tax Portal), maintenance costs when the property sits vacant (₹2,000-₹5,000 monthly), property management fees if you hire someone to handle tenants (usually 5-8% of rent), periodic repairs and painting (₹15,000-₹30,000 every 2-3 years), and insurance (₹5,000-₹10,000 annually).

On the investment side, don’t just count the property price. Your total investment includes registration and stamp duty, which runs 5-7% in Karnataka (check current rates at Karnataka Stamp Duty Portal), brokerage fees if applicable (1-2%), and interior work or furnishing (₹2-5 lakhs depending on the property condition).

Real Example: Whitefield 2BHK

You buy a property for ₹1 crore. Add stamp duty and registration (₹6 lakhs), brokerage (₹2 lakhs), and furnishing (₹3 lakhs). Your total investment is ₹1.11 crores.

The property rents for ₹40,000 monthly, giving you ₹4.8 lakhs annual rent. But you’ll spend about ₹80,000 annually on expenses. Your net yield = [(₹4,80,000 – ₹80,000) ÷ ₹1,11,00,000] × 100 = 3.6%.

Why this matters: A property showing 6% gross yield might only give you 4% net. Always calculate net yield.

The 12% Total Return Rule

Smart investors look beyond just rental yield. Here’s the formula that actually matters:

Total Return = Rental Yield + Capital Appreciation

Target a minimum 12% total annual return. For example, if you’re getting 4% rental yield and the property appreciates 8-10% annually in a high-growth area, your total return is 12-14%. If your total return falls below 12%, you’re better off putting money in index funds or other investments.

Top 7 Bangalore Localities for Maximum Rental ROI (2026 Rankings)

Based on current yields, tenant demand, capital appreciation potential, and infrastructure development—here are the winners.

#1: Electronic City – The Yield Champion

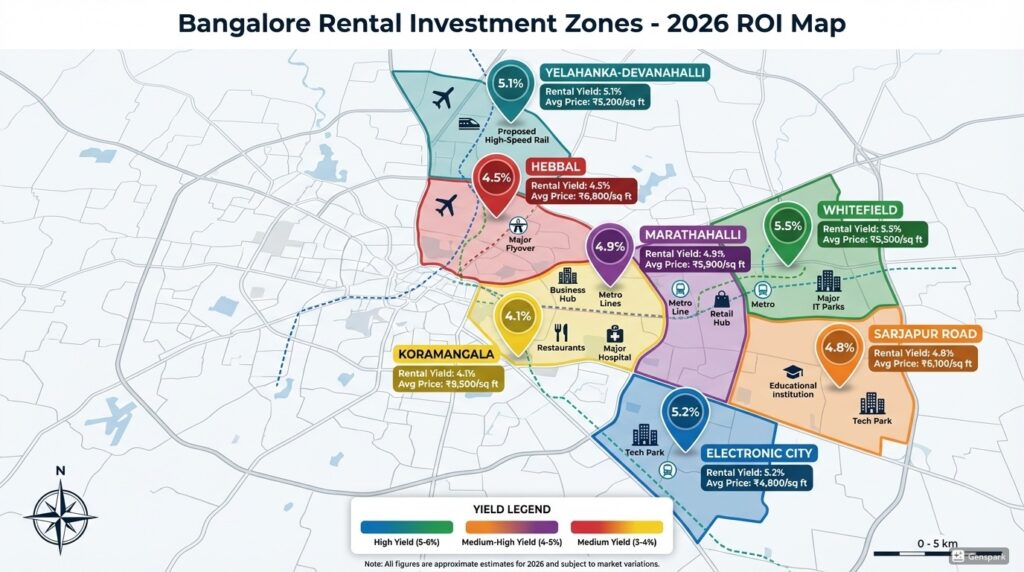

Quick Stats: Property prices average ₹5,000-₹6,500 per sq ft, 2BHK rents run ₹15,000-₹25,000 monthly, rental yields hit 4.5-5.5% (highest in Bangalore), and capital appreciation averages 8-10% annually.

Why Electronic City Delivers

Electronic City has become the yield champion for one simple reason: massive, consistent tenant demand from the IT workforce. Infosys alone employs over 40,000 people here. Add Wipro’s 25,000+ employees, plus major campuses from TCS, HCL, Biocon, and CTS, and you’re looking at a total IT workforce exceeding 150,000 people—all needing housing within commuting distance.

The infrastructure works in investors’ favor too. The Metro Yellow Line is already operational in Phase 1, there’s an elevated expressway connecting to ORR, NICE Road provides easy access, and Hosur Road keeps you connected to the rest of the city. Schools like Ebenezer International, IFIM, and National Public School attract families. Apollo and Narayana Health handle healthcare needs. Total Mall and Reliance Mart cover shopping essentials.

Here’s what the numbers look like in practice: A typical 1,200 sq ft apartment costs ₹60-78 lakhs. Monthly rent ranges from ₹22,000 to ₹28,000, which translates to annual rent of ₹2.64-₹3.36 lakhs. Your gross yield? A solid 4.4-4.8%.

Best micro-markets to target:

- Electronic City Phase 1 – Closer to Infosys campus, premium demand

- Hebbagodi – More affordable entry point, good connectivity

- Konappana Agrahara – Near Metro station, family-friendly

The tenant profile here is straightforward: IT professionals, industrial workers, and young families. Vacancy risk stays low because demand is consistent year-round.

Investment Strategy for Electronic City

This locality works best for first-time investors who want affordable entry into Bangalore real estate, NRIs seeking passive income without high capital deployment, and anyone prioritizing yield over luxury appreciation.

Focus on 2BHK apartments between 900-1,200 sq ft—this is where demand peaks. Semi-furnished or unfurnished units work well because they cost less upfront and still attract quality tenants. Stay away from 3BHK or 4BHK units unless you have a specific tenant lined up; these face longer vacancies and lower demand. Luxury properties also tend to underperform here, with yields dropping to 3-3.5%.

Electronic City won’t give you explosive 20% capital appreciation, but the yields remain strong and stable. If you’re building a rental portfolio for steady income, this is your starting point.

#2: Whitefield – The Balanced Performer

Quick Stats: Property prices average ₹8,000-₹9,500 per sq ft, 2BHK rents run ₹25,000-₹40,000 monthly, rental yields hit 4-5%, and capital appreciation averages 10-12% annually.

Why Whitefield is Investor-Favorite

Whitefield has evolved from just an IT hub into a complete live-work-play ecosystem, and that’s what makes it such a solid investment. International Tech Park Bangalore (ITPB) alone houses 50,000+ employees. Add Brigade Tech Park, Sigma Soft Tech Park, SAP Labs, and numerous startups and MNCs, and you’ve got a tenant pool that’s both massive and affluent.

The infrastructure is genuinely impressive. The Metro Purple Line is operational, giving direct connectivity to the city. Whitefield Main Road and ORR access keep commutes manageable. The upcoming Peripheral Ring Road will be a game-changer, and there are plans for an elevated corridor that’ll reduce congestion even further.

What really sets Whitefield apart is the lifestyle quotient. Phoenix Market City, Nexus Mall, and VR Bengaluru handle shopping and entertainment. Top international schools like EuroKids and Oakridge attract families willing to pay premium rents. Premium hospitals like Manipal, Columbia Asia, and Sakra ensure medical needs are covered.

A typical 1,200 sq ft apartment runs ₹96 lakhs to ₹1.14 crores. Monthly rent ranges from ₹35,000 to ₹45,000, which translates to annual rent of ₹4.20-₹5.40 lakhs. Your gross yield lands at 4.4-4.7%.

Best micro-markets to consider:

- Whitefield Main Road – Premium demand, established infrastructure

- Ramagondanahalli – Affordable Whitefield, good value

- Seegehalli – Near Metro, family-friendly pricing

- Hope Farm area – Gated communities, strong family appeal

You’ll attract mid-senior IT professionals, expats, and small families. Vacancy risk is low to moderate—there’s competition, but demand stays strong.

Investment Strategy for Whitefield

This works for investors seeking balanced returns (yield plus appreciation), those targeting premium tenants who pay on time and stay longer, and anyone building long-term wealth through real estate.

Stick to 2BHK for maximum liquidity, though 3BHK in good gated communities works well for families. Furnished apartments can command 15-20% premium rent if you’re targeting expats or corporate tenants.

Here’s a real example: An investor bought a 1,200 sq ft apartment in Whitefield for ₹96 lakhs in 2023. Today it rents at ₹50,000/month, delivering 6.25% annual yield. The property value has appreciated to ₹1.08 crores—that’s 12.5% appreciation in just 2 years. For detailed Whitefield investment analysis, check our complete Whitefield Property Guide 2025.

#3: Sarjapur Road – The Growth Story

Quick Stats: Property prices average ₹6,500-₹8,500 per sq ft, 2BHK rents run ₹20,000-₹35,000 monthly, rental yields hit 4-4.8%, but capital appreciation is the real story at 15-18% annually.

Why Sarjapur is the Smart Long-Term Bet

Sarjapur Road has been the appreciation monster of Bangalore real estate. Average prices stood at ₹6,050 per sq ft at the end of 2021. By Q2 2025, they’d hit ₹10,800 per sq ft. That’s 79% growth in just 3.5 years.

The location advantage is clear. You’re close to the ORR IT corridor, with Wipro SEZ and RGA Tech Park nearby. Easy access to Whitefield, Bellandur, and HSR Layout means multiple employment zones within 10-15 km. The infrastructure boom is just getting started—the proposed Sarjapur-Hebbal Metro Line will be a complete game-changer once it’s operational. You’ve got ORR connectivity, Hosur Road access, and roads and flyovers constantly improving.

Families love Sarjapur Road for good reason. International schools like Oakridge, Greenwood High, and Indus International have set up here. Manipal and Cloudnine handle healthcare. Malls and lifestyle centers are coming up rapidly.

A typical 1,400 sq ft apartment costs ₹91 lakhs to ₹1.19 crores. Monthly rent ranges from ₹30,000 to ₹40,000 (annual rent: ₹3.60-₹4.80 lakhs). Your gross yield sits at 3.8-4.6%—not the highest, but wait for the appreciation story.

Best micro-markets:

- Dommasandra Circle – Affordable entry, good for budget investors

- Carmelaram – Established area, consistent demand

- Soukya Road – Premium pocket, near top schools

Your tenants will be IT professionals and families with kids. Vacancy risk is moderate—the area’s growing fast, so there’s competition.

Investment Strategy for Sarjapur Road

This is for investors prioritizing capital gains over immediate yield, those with a 5-10 year investment horizon, and anyone willing to accept slightly lower initial yield for massive appreciation potential.

Real investor story: Someone purchased a 1,500 sq ft apartment on Sarjapur Road for ₹1.05 crores in 2022. Current rent is ₹40,000/month (₹4.80 lakh/year), delivering 4.6% yield. Property value today? ₹1.25 crores—that’s 19% appreciation in 3 years.

Why this works: Lower initial yield (4-4.5%) but massive capital appreciation (15-18%) equals excellent total returns. If you’re patient, Sarjapur Road delivers.

#4: Marathahalli – The Budget IT Hub

Quick Stats: Property prices average ₹7,500-₹9,800 per sq ft, 2BHK rents run ₹18,000-₹30,000 monthly, rental yields hit 4-4.5%, and capital appreciation averages 8-10% annually.

Why Marathahalli Works for Investors

Marathahalli sits right on the Outer Ring Road, which is Bangalore’s prime IT corridor. You’re positioned between Whitefield and Bellandur, with close access to multiple tech parks. The future Metro Yellow Line extension is planned, which will boost connectivity further. The constant influx of IT professionals keeps demand steady. The area’s more affordable compared to Whitefield or Koramangala, making it accessible for young professionals and bachelor groups.

ORR gives direct access to major employment zones. Old Airport Road connectivity helps too. Local amenities are fully developed—you’re not betting on future infrastructure here.

A typical 1,200 sq ft apartment costs ₹90 lakhs to ₹1.17 crores. Monthly rent ranges from ₹24,000 to ₹32,000 (annual rent: ₹2.88-₹3.84 lakhs). Gross yield lands at 3.2-4.3%.

Best micro-markets:

- Kadubeesanahalli – Near ORR, premium demand

- Spice Garden area – Established gated communities

- Karthik Nagar – More affordable, budget-friendly

You’ll get young IT professionals, bachelors, and small families. Vacancy risk is low because demand is constant.

Investment Strategy for Marathahalli

Best for budget-conscious investors who want to enter Bangalore real estate without stretching finances, those targeting volume (buying multiple properties), and short-to-medium term holds (5-7 years).

Focus on 2BHK apartments—this is the sweet spot. Smaller units (900-1,100 sq ft) work well for bachelor tenants. Unfurnished properties do fine because tenants prefer customizing their space.

The challenge? Traffic congestion and commercial overload in some pockets. Choose gated communities over standalone buildings to avoid these issues.

#5: Hebbal – The Airport Corridor Winner

Quick Stats: Property prices average ₹7,000-₹8,650 per sq ft, 2BHK rents run ₹22,000-₹35,000 monthly, rental yields hit 5-6% (very high), and capital appreciation averages 12-15% annually.

Why Hebbal is 2026’s Hotspot

Hebbal’s infrastructure advantage is undeniable. Kempegowda International Airport is just 40 minutes away. Bellary Road, ORR, and Hebbal Flyover provide excellent connectivity. Metro connectivity is improving steadily. The Peripheral Ring Road (PRR) will pass through this area, which will transform it completely.

Manyata Tech Park houses 80,000+ employees who need housing nearby. The BIAL IT Investment Region is developing just north of here, creating fresh employment opportunities. Easy access to North Bangalore offices makes it attractive to a broader tenant base.

Here’s what makes it interesting: You’re getting lower prices than Koramangala or Indiranagar, but premium gated communities are available. The area is still developing, which means room for significant appreciation over the next 5-7 years.

A typical 1,300 sq ft apartment costs ₹91 lakhs to ₹1.12 crores. Monthly rent ranges from ₹28,000 to ₹38,000 (annual rent: ₹3.36-₹4.56 lakhs). Gross yield hits 3.7-5.1%.

Best micro-markets:

- Yelahanka – Near airport, consistent demand from aviation sector

- Nagavara – Lakefront living, premium appeal

- HBR Layout – Established, family-friendly

Your tenant base includes airport staff, IT professionals, and business travelers. Vacancy risk is low because you’ve got diverse tenant profiles.

Investment Strategy for Hebbal

This works for those believing in North Bangalore’s growth story, investors seeking emerging market gains before prices peak, and properties targeting corporate rentals (airport proximity matters).

The opportunity here is timing. Hebbal is still reasonably priced compared to its potential. As PRR develops and more companies move north to avoid South Bangalore traffic, Hebbal will appreciate significantly.

#6: Koramangala – The Premium Play

Quick Stats: Property prices average ₹10,000-₹15,000 per sq ft, 2BHK rents run ₹30,000-₹55,000 monthly, rental yields hit 3-3.8% (lower but stable), and capital appreciation averages 8-10% annually.

Why Koramangala Still Makes Sense

Koramangala attracts a different tenant profile altogether: startup founders, CXOs, senior professionals, expats, and consultants. These are high-paying, stable tenants who value location and lifestyle over saving ₹5,000 on rent.

The location advantage is unbeatable. You’re in Central Bangalore, which means 30 minutes to most major areas. The neighborhood is genuinely walkable—cafes, restaurants, malls, everything’s accessible without a car. Social infrastructure is completely established.

The lifestyle premium is real. Koramangala Social, Third Wave Coffee, hundreds of restaurants and bars, Nexus Mall, Oasis Centre, premium gyms, salons, co-working spaces—it’s all here. For tenants who work in startups or senior roles, this isn’t just housing, it’s a lifestyle.

A typical 1,400 sq ft apartment costs ₹1.4 to ₹2.1 crores. Monthly rent ranges from ₹45,000 to ₹65,000 (annual rent: ₹5.40-₹7.80 lakhs). Gross yield lands at 3.2-3.9%.

Best micro-markets:

- Blocks 5-8 – Commercial hub, higher rents, younger crowd

- Blocks 1-4 – Family-friendly, stable demand, quieter

You’ll attract senior professionals, expats, and entrepreneurs. Vacancy risk is moderate—premium properties take longer to rent, but once rented, tenants stay.

Investment Strategy for Koramangala

Best for high-net-worth investors who can afford the entry price, those prioritizing capital stability over high yield, and investors targeting the premium tenant segment who pay reliably and maintain properties well.

Reality check: Yield is lower (3-3.8%), but you get zero vacancy risk (always in demand), premium reliable tenants, strong brand value (property in Koramangala equals status), and lower depreciation. For detailed analysis, read our Koramangala Apartments Guide 2025.

#7: Yelahanka & Devanahalli – The Future Bet

Quick Stats: Property prices average ₹4,500-₹6,500 per sq ft, 2BHK rents run ₹15,000-₹25,000 monthly, rental yields hit 4.5-5.5%, and capital appreciation is explosive at 20-25% annually.

Why North Bangalore is the Dark Horse

The airport effect is powerful. Kempegowda International Airport proximity means aviation industry employees need housing. Business travelers often rent short-term. Flight crew and ground staff create consistent demand.

The BIAL IT Investment Region is being developed as a massive IT zone. Companies are moving north to avoid Bangalore’s infamous traffic. A fresh employment hub is emerging, and it’s still early enough to get in at reasonable prices.

Infrastructure is catching up fast. The Navayuga Devanahalli KIAL Expressway is operational. NH44 provides connectivity. Suburban rail is planned, which will transform commutes.

The rental surge has been dramatic: 20-25% increase in rental rates over the past 2 years. Emerging corridors like Bagalur and Nelamangala are booming. Despite all this, it’s still very affordable.

A typical 1,200 sq ft apartment costs ₹54-78 lakhs. Monthly rent ranges from ₹18,000 to ₹25,000 (annual rent: ₹2.16-₹3.00 lakhs). Gross yield sits at 4-5.5%.

Best micro-markets:

- Yelahanka New Town – Established, safer bet

- Devanahalli – Near airport, highest growth potential

- Bagalur – Explosive growth, higher risk

Your tenants will be airport staff, aviation industry employees, and IT professionals relocating north. Vacancy risk is moderate to high—it’s an emerging market, not fully matured yet.

Investment Strategy for North Bangalore

This is for aggressive growth investors who understand risk-reward dynamics, long-term holders with a 7-10 year horizon, and those willing to accept initial vacancy risk for potentially massive returns.

The risk-reward calculation: Higher risk (developing infrastructure, tenant pool still growing), but potentially highest returns in 5-10 years. If North Bangalore develops as planned, early investors will see exceptional gains.

Bangalore Rental Yield Comparison Table (2026)

| Locality | Avg Price/sq ft | 2BHK Rent/Month | Gross Yield | Capital App | Total Return | Best For |

|---|---|---|---|---|---|---|

| Electronic City | ₹5,500 | ₹20,000 | 4.5-5.5% | 8-10% | 12.5-15.5% | First-time investors |

| Whitefield | ₹9,000 | ₹35,000 | 4-5% | 10-12% | 14-17% | Balanced returns |

| Sarjapur Road | ₹7,500 | ₹30,000 | 4-4.8% | 15-18% | 19-23% | Long-term gains |

| Marathahalli | ₹9,000 | ₹25,000 | 4-4.5% | 8-10% | 12-14.5% | Budget investors |

| Hebbal | ₹7,800 | ₹30,000 | 5-6% | 12-15% | 17-21% | Emerging winners |

| Koramangala | ₹12,500 | ₹50,000 | 3-3.8% | 8-10% | 11-13.8% | Premium play |

| Yelahanka | ₹5,500 | ₹20,000 | 4.5-5.5% | 20-25% | 24.5-30.5% | High-risk/reward |

Key Takeaway: If you want highest yield NOW, focus on Electronic City or Hebbal. If you want highest total returns, consider Sarjapur Road or Yelahanka.

Property Types: What Actually Rents Fast in Bangalore

Not all properties are created equal. Here’s what tenants actually want.

2BHK Apartments: The Sweet Spot

This is where maximum demand lives. Ideal size is 900-1,200 sq ft. Your tenant profile includes young couples, small families, and IT professionals. Typical vacancy period is just 15-30 days.

Why 2BHK wins every time: It’s affordable for most tenants (₹20K-40K rent range), perfect for nuclear families, easy to furnish and maintain, and highly liquid when you eventually sell. If you’re buying one property, make it a 2BHK.

3BHK Apartments: For Families

Demand is good but more selective. Ideal size is 1,400-1,800 sq ft. Your tenants are families with kids and senior professionals. Expect 30-60 days vacancy period.

3BHK works well in family-friendly areas like HSR Layout, JP Nagar, and Jayanagar, near good schools, and in gated communities with amenities. The challenge is a smaller tenant pool and higher rents (₹35K-60K) that limit affordability.

1BHK/Studio: For Bachelors

Demand is moderate. Ideal size is 500-700 sq ft. Tenants are single professionals and students. Vacancy period runs 20-40 days.

Pros: Lower investment, high yield potential (5-7% possible), easy maintenance

Cons: High tenant turnover (every 11 months), faster wear and tear, less appreciation potential

Best locations are near IT parks, metro stations, and PG-heavy areas.

Villas/Independent Houses: Niche Market

Demand is low. Your tenant profile is expats, large families, or corporate housing. Vacancy period can stretch 60-180 days.

Rental yield is lowest at 2.5-3.5%. Capital appreciation can be high in good locations. Investment verdict: NOT recommended unless you have a specific tenant lined up or corporate tie-up. Apartments are always more liquid.

Furnished vs Unfurnished

Furnished apartments can charge 15-30% premium rent and attract expats and corporate tenants, but you’ll deal with higher maintenance costs and furniture depreciation. Unfurnished brings lower rent but longer tenancies, less maintenance headache, and tenants who customize (making it feel like home).

Smart strategy: Go semi-furnished. Include basics like modular kitchen, wardrobes in all bedrooms, geysers in bathrooms, lights and fans, and curtain rods. Let tenants add bed, sofa, dining table, TV, fridge, and washing machine. This approach gives you lower initial investment, less maintenance hassle, attracts both families and bachelors, and 10-15% rent premium over unfurnished.

For NRI Investors: Tax, TDS & Repatriation Rules (2026)

If you’re an NRI investing in Bangalore rental property, these tax rules WILL impact your returns.

Tax on Rental Income for NRIs

The tenant must deduct 31.2% (30% plus 4% cess) from your monthly rent BEFORE paying you, as per Section 195 of the Income Tax Act.

Example: Monthly rent is ₹40,000. TDS deducted is ₹12,480. You receive ₹27,520. Important: This 31.2% is just withholding tax. Your actual tax might be lower after deductions.

Deductions Available to NRIs

You get a standard deduction of 30% of Net Annual Value automatically. Municipal taxes paid are fully deductible. Home loan interest is 100% deductible if the property is rented. Principal repayment gets you up to ₹1.5 lakh under Section 80C.

Real calculation example:

Annual rent: ₹4,80,000

Less standard deduction (30%): ₹1,44,000

Less municipal tax paid: ₹12,000

Less home loan interest: ₹2,00,000

Taxable rental income: ₹1,24,000

Tax at 30% slab: ₹37,200

But TDS already deducted: ₹1,49,760

Refund due to you: ₹1,12,560

Action required: File ITR to claim this refund. Many NRIs don’t and lose money.

Repatriation (Sending Rent Abroad)

Rent must go to your NRO account first after TDS deduction. To send money abroad, get Form 15CB from a Chartered Accountant, file Form 15CA on the Income Tax portal, submit both to your bank with tax documents, and the bank transfers funds to your foreign account. Annual limit is USD 1 million after taxes.

Tip: If your tenant is also an NRI paying from their NRE account, rent can go directly to your NRE account as a tax-free transfer.

Capital Gains When Selling

Short-term gains (sold within 2 years) are taxed at your slab rate (30%). Long-term gains (held 2+ years) are taxed at 20% with indexation OR 12.5% without.

Exemptions available:

- Section 54: Reinvest in another residential property to get exemption

- Section 54EC: Invest in capital gain bonds (₹50 lakh limit)

For NRIs, the buyer deducts 12.5% TDS when purchasing your property.

Double Taxation Avoidance (DTAA)

If you live in USA, UK, Canada, Australia, UAE, Singapore, or any of the 90+ countries with which India has DTAA, you can claim Foreign Tax Credit in your country of residence. This reduces or eliminates double taxation. Consult a CA familiar with DTAA provisions.

Example for US-based NRI: You paid 31.2% TDS in India. Claim credit in US taxes. Your effective tax rate gets optimized.

Helpful resources for NRIs:

DTAA tax treaties: India has Double Taxation Avoidance Agreements with 90+ countries. Check your country’s specific treaty on Income Tax Department’s DTAA page.

Property Management for NRIs

Challenge: Managing tenant, maintenance, and rent collection from abroad.

Solution: Professional property management costs 5-8% of monthly rent. Services include tenant screening, rent collection, maintenance coordination, quarterly inspections, and tax compliance.

Is it worth it? If your time is valuable and you want zero hassle—absolutely yes. For NRI investors, professional property management services can handle tenant verification, rent collection, and maintenance coordination, allowing you to earn passive income without operational hassle.

Investment Mistakes That Will Kill Your Returns

I’ve seen investors lose lakhs because of these mistakes. Don’t be one of them.

Mistake #1: Chasing High Rents Over Yield

Wrong thinking: “This Koramangala flat gets ₹60K rent! That’s ₹7.2 lakhs a year!”

Reality check: Property cost is ₹2 crores. Yield is just 3.6%.

Better option: Electronic City flat for ₹70 lakhs getting ₹28K rent delivers 4.8% yield.

Why it matters: Higher absolute rent doesn’t mean better returns. Calculate yield, not just rent amount.

Mistake #2: Ignoring Vacancy Costs

What investors forget: Average vacancy is 1-2 months between tenants. Lost rent of ₹40,000 × 2 = ₹80,000. Add painting and cleaning before new tenant (₹25,000). Total cost: ₹1,05,000.

Smart calculation: Assume property is vacant 2 months every 2 years. Factor this into your yield calculations from day one.

Mistake #3: Buying in Builder-Promised “Upcoming” Areas

Red flag: Builder says “Metro coming in 3 years, airport nearby, tech park planned…”

Reality: Infrastructure gets delayed 5-10 years. Meanwhile, property sits vacant, no tenant demand materializes, and price appreciation stalls.

Better approach: Buy where infrastructure EXISTS TODAY, not “will come.” Completed metro stations beat “proposed” ones every time.

Mistake #4: Overleveraging

Risky strategy that kills investors: Buy ₹1 crore property, take ₹80 lakh loan at 9% interest, rent it for ₹35,000/month, but EMI is ₹71,000/month. Negative cash flow: ₹36,000/month bleeding out.

Why people do this: Expecting property value to double in 3 years. Reality: If property doesn’t appreciate fast enough OR you can’t find tenant, you’re bleeding money every month.

Safe approach: Maximum 60-70% loan. Ensure EMI is less than rent (positive cash flow). Have 6-12 months EMI as emergency fund.

Mistake #5: Ignoring Tenant Profile

Example: Investor buys luxury 3BHK in Electronic City for ₹1.5 crores.

Problem: Electronic City tenants are young IT professionals who want affordable 2BHKs (₹20K-30K). Luxury 3BHK tenant pool is tiny. Property sits vacant for 6 months.

Right strategy: Match property type to locality’s tenant profile. Don’t fight market demand.

Mistake #6: Not Doing Legal Due Diligence

Shortcuts investors take: Skip Encumbrance Certificate check, don’t verify Khata, trust builder without lawyer review.

Cost of mistakes: Disputed property (can’t rent OR sell), legal battles (lakhs in lawyer fees), stress and time wasted. Total loss: ₹1.2-3.6 lakhs minimum.

Understanding Your Legal Rights

The Model Tenancy Act 2021 provides framework for rental agreements across India. While Karnataka has its own rent control laws, the Model Tenancy Act provides standardized guidelines that influence state-level regulations. Key provisions include security deposit limits, rental agreement registration, and dispute resolution mechanisms.

Non-negotiable checks before buying:

- BBMP Khata verification

- Encumbrance Certificate (last 30 years clear)

- Lawyer review of sale deed

- Builder RERA registration (check on Karnataka RERA portal)

For complete guidance on real estate documentation, verify all necessary paperwork before finalizing any property purchase.

Mistake #7: Buying During Market Peak

Emotional buying: “Prices are going up 20% a year! I need to buy NOW or I’ll miss out!”

Result: Bought at ₹12,000/sq ft. Market corrects. Now worth ₹10,500/sq ft.

Smarter approach: Track price trends for 6-12 months before committing. Buy during slower months (June-August, post-festivals) when seller urgency is higher. Negotiate hard—most sellers are flexible when property’s been listed for months.

Best time to buy:

- Monsoon season (fewer buyers competing)

- Year-end (sellers want to close books)

- When property’s been listed 3+ months (seller getting anxious)

How to Actually Maximize Your Rental Returns (Proven Strategies)

Now let’s talk about what ACTUALLY works to boost your rental income and ROI.

Strategy #1: Target the Right Property Size

Data from 5,000+ Bangalore rentals shows clear patterns:

Fastest to rent:

- 2BHK, 900-1,100 sq ft: Average vacancy 20 days

- 2BHK, 1,100-1,300 sq ft: Average vacancy 25 days

Slowest to rent:

- 4BHK: Average vacancy 90+ days

- Villas/independent houses: 120+ days

Takeaway: Stick to 2BHK. Highest liquidity, fastest rent-out, best appreciation across market cycles.

Strategy #2: Strategic Furnishing

| Furnishing Level | Rent Premium | Target Tenant | Maintenance Cost |

|---|---|---|---|

| Unfurnished | Baseline | Families (long stay) | Lowest |

| Semi-furnished | +10-15% | Mix | Low |

| Fully furnished | +20-30% | Bachelors, expats | Highest |

Smart strategy is semi-furnished for best ROI. Include modular kitchen, wardrobes in all bedrooms, geyser in bathrooms, lights and fans, and curtain rods. Let tenant add bed, sofa, dining table, TV, fridge, and washing machine.

Why this works: Lower initial investment, less maintenance hassle, attracts both families and bachelors, and 10-15% rent premium over unfurnished.

Strategy #3: Choose the Right Tenant

Reality: Good tenant equals 10X better investment experience.

Red flags to avoid:

- Frequent job changes (stability issues)

- Bad credit history

- Previous eviction or police cases

- Multiple occupants (subletting risk)

Green flags to look for:

- Stable job (2+ years in current company)

- Clean background check

- Willing to do 23-month lease (instead of 11 months)

- Professional references check out

Screening process: Complete police verification (mandatory in Karnataka – use Karnataka Police Tenant Verification Portal), employment verification (HR letter, salary slips), previous landlord reference, and credit check if available.

Cost of bad tenant: Delayed rent (₹40K-80K lost), property damage (₹50K-2L in repairs), legal eviction (₹30K-1L in lawyer fees). Total loss: ₹1.2-3.6 lakhs.

Investment in good screening: ₹5,000-10,000. Worth it? ABSOLUTELY.

Strategy #4: Price Smartly

Don’t just copy nearby listings. Analyze demand and supply dynamics.

Example: You find 5 similar 2BHKs nearby all listed at ₹30,000/month.

Smart move: List yours at ₹28,500 (5% lower).

Result: Gets rented in 10 days versus 45 days for others. You save ₹30,000 in vacancy costs. Happy tenant stays longer.

Math: You lose ₹1,500/month × 12 = ₹18,000 annually. But you saved ₹30,000 in vacancy plus hassle. Net benefit: ₹12,000 plus peace of mind.

Strategy #5: Maintenance Timing Matters

Bad approach: Wait for tenant to complain about broken tap, then fix. Result: Tenant unhappy, negative review, leaves after 11 months.

Good approach: Proactive maintenance every 6 months. Deep clean, plumbing check, electrical check, pest control, painting touchup if needed.

Cost: ₹5,000-8,000 every 6 months. Benefit: Tenant renews lease, stays 2-3 years, zero vacancy costs.

Tenant retention equals lower vacancy equals higher effective yield.

Strategy #6: Annual Rent Escalation (The Right Way)

What tenants hate: Surprise 10% increase announcement.

What works: Pre-agreed escalation in initial contract.

Example clause: “Rent for Year 1: ₹25,000/month. Year 2: ₹26,500/month (6% increase). Year 3: ₹28,100/month (6% increase).”

Why tenants accept this: It’s predictable (they can budget), reasonable increase (not exploitative), and avoids renegotiation stress.

Why you benefit: Guaranteed 6% rent growth, tenant stays longer (moving is expensive for them), no vacancy between years.

Strategy #7: Professional Management (When It’s Worth It)

When DIY makes sense: You live in Bangalore, you have time, and you own just one property.

When to hire professional management: You’re an NRI, you own multiple properties, your time is valuable, or you travel frequently.

What good property managers do: Tenant screening with background checks, automated rent collection, maintenance coordination, quarterly property inspections, tax compliance and documentation, renewal negotiations, and emergency handling.

Cost: 5-8% of monthly rent. Example: ₹30,000 rent means ₹1,800-2,400/month fee.

ROI analysis:

Without manager: Your time is 5-10 hours/month. If your hourly rate is ₹2,000/hour (conservative), opportunity cost is ₹10,000-20,000/month.

With manager: Cost is ₹2,400/month. Your time saved: 5-10 hours. Net benefit: ₹7,600-17,600/month plus peace of mind.

Plus: Professional managers get better tenants (less vacancy), faster rent-outs, and fewer problems overall.

FAQs: Bangalore Rental Investment (2026)

Q: What is the minimum investment needed for rental property in Bangalore?

Entry-level options in Electronic City or Yelahanka run ₹50-70 lakhs for a 2BHK. Add 25% for additional costs (stamp duty, registration, furnishing), bringing total to ₹62.5-87.5 lakhs. Realistic budget: ₹70 lakhs minimum.

Comfortable investment: ₹1-1.2 crores gets you good property in Whitefield, Marathahalli, or Sarjapur with monthly rent of ₹30K-40K and annual return of ₹3.6-4.8 lakhs.

Q: Which locality gives the highest rental yield in Bangalore?

Top three are Electronic City (4.5-5.5%), Hebbal/Yelahanka (5-6%), and Marathahalli (4-4.5%).

But remember: Higher yield doesn’t mean better investment if appreciation is low. Look at total returns (yield plus appreciation).

Q: Is it better to buy ready-to-move or under-construction for rental?

Ready-to-move lets you start earning rent immediately, has no construction risk, and you see the actual property. Downside: Higher price.

Under-construction offers lower price (10-20% discount) and payment spread over 2-3 years. Downside: Rental income delayed 2-3 years and construction risk (delays, quality issues).

For rental investors: Ready-to-move is better. Start earning returns immediately. For more details, read our guide on Ready-to-Move vs Under-Construction Flats.

Q: How much can I expect in annual rent escalation?

Standard in Bangalore is 5-10% per year. This depends on area (premium areas: 5-7%, emerging areas: 8-12%), property condition, and market demand.

Tip: Include escalation clause in initial agreement to avoid negotiation hassles later.

Q: Should I buy apartment or independent house for rental?

Apartments win for rental investors on every metric:

| Factor | Apartment | Independent House |

|---|---|---|

| Rental Yield | 4-6% | 2.5-4% |

| Vacancy Period | 20-40 days | 60-180 days |

| Maintenance | Low | High |

| Security | Gated | Owner’s responsibility |

| Tenant Pool | Large | Small (mostly expats) |

| Liquidity | High | Moderate |

Verdict: Unless you have corporate tenant tie-up, stick to apartments.

Q: What are the tax implications of rental income?

For Resident Indians: Rental income taxed as per your slab, standard deduction of 30% of Net Annual Value, municipal tax fully deductible, and home loan interest deductible under Section 24(b).

For NRIs: TDS of 31.2% (30% plus 4% cess), same deductions available, must file ITR to claim refund, rent received in NRO account, and can repatriate up to USD 1 million per year.

Q: How long should I hold rental property in Bangalore?

Minimum: 5 years. Ideal: 7-10 years.

Why? Short-term capital gains tax (if sold within 2 years) is 30%. Long-term capital gains is 12.5% or 20%. Property values take 5-7 years to appreciate significantly. Rental yield compounds over time.

Break-even: Most investors break even (covering all costs) in 4-5 years.

Q: Can I get home loan for rental property?

Yes, but banks give home loans for “self-occupied” properties. If you’re taking loan claiming self-occupation, you technically can’t immediately rent. Many investors take loan for “self-occupied”, then rent after 1-2 years.

Alternative: Take loan, claim self-occupied. After 1-2 years, inform bank you’re renting out. Continue paying EMI normally.

Better option for investors: Loan Against Property (LAP) if you own other property. Interest rates slightly higher but more flexible terms.

Q: What if property remains vacant for long?

Budget for vacancy: Assume 1-2 months vacant every 2 years. Factor this into yield calculations from day one.

If vacant beyond 2 months: Reduce rent by 5-10%, increase marketing (more platforms), check if competing properties are priced lower, consider semi-furnishing to attract more tenants, or hire property consultant.

Emergency fund: Keep 6 months’ EMI saved for worst-case scenario.

Q: Should I use property management company?

Use professional management if you’re an NRI, own 2+ properties, have full-time job (no time for management), travel frequently, or value peace of mind over saving money.

Cost: 5-8% of monthly rent. What you get: Tenant screening, rent collection, maintenance coordination, quarterly inspections, and tax compliance.

Q: What’s better—buying one expensive property or multiple cheap ones?

Depends on your goal.

One expensive property (₹1.5-2 crores): Less management hassle, premium tenant, better appreciation. Downside: All eggs in one basket.

Multiple budget properties (2-3 properties × ₹60-80 lakhs each): Risk diversification, higher total yield, more liquidity. Downside: More management effort.

For first-time investors: Start with one solid property. Add more once you understand the process.

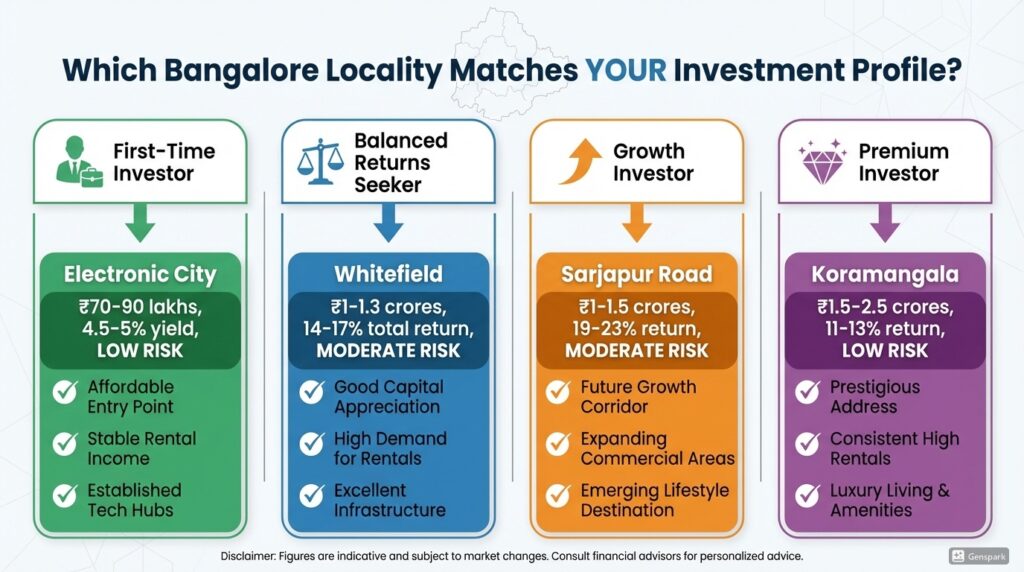

The Bottom Line: Where Should YOU Invest?

After all this data, here’s my honest recommendation based on investor type:

If you’re a first-time investor: Electronic City is your best choice. Why? Highest yield, lowest entry cost, consistent demand, proven rental market. Budget: ₹70-90 lakhs. Expected yield: 4.5-5%. Risk: Low.

If you want balanced returns: Whitefield delivers. Why? Good yield (4-5%) plus strong appreciation (10-12%), established market. Budget: ₹1-1.3 crores. Expected total return: 14-17%. Risk: Low to Moderate.

If you’re chasing maximum capital gains: Sarjapur Road is the play. Why? 15-18% annual appreciation, infrastructure boom, metro coming. Budget: ₹1-1.5 crores. Expected yield: 4-4.5% (moderate). Expected appreciation: 15-18% (highest). Risk: Moderate.

If you’re an aggressive growth investor: Hebbal/Yelahanka/Devanahalli offers explosive potential. Why? Growth potential of 20-25%, still affordable, emerging market. Budget: ₹60-90 lakhs. Expected total return: 25-30%. Risk: Moderate to High (vacancy risk initially).

If you’re a premium investor: Koramangala provides stability. Why? Zero vacancy risk, premium tenants, brand value, stable returns. Budget: ₹1.5-2.5 crores. Expected yield: 3-3.8% (lower). Expected appreciation: 8-10%. Risk: Low (safest investment).

Final Thoughts: Build Wealth Through Smart Rental Investing

Look, rental property investment isn’t a get-rich-quick scheme.

But done right—picking the right locality, right property type, right tenant—it’s one of the most reliable wealth-building strategies out there.

Here’s what makes Bangalore rental investment powerful: Predictable returns of 12-20% total annual returns (yield plus appreciation), passive income flowing in monthly automatically, inflation hedge as rents increase 5-10% annually, tangible asset you control, tax benefits on loan interest and depreciation, and leverage opportunity using bank’s money (home loan) to multiply returns.

The key? Don’t rush. Do your homework. Run the numbers. Visit properties. Verify everything.

Whether you’re an NRI building passive income, a Bangalore resident diversifying wealth, or a first-time investor dipping toes into real estate, Bangalore offers opportunities at every budget level.

For professional guidance on finding high-ROI properties with complete due diligence, consider working with experienced real estate consultants who can help you identify verified investment-grade properties and calculate accurate returns.

Your next rental property is waiting. Let’s find it.

Last Updated: January 2026

Disclaimer: Rental yields, property prices, and appreciation rates are indicative and based on 2026 market data. Actual returns may vary based on property specifics, market conditions, and management. Always conduct independent due diligence and consult financial advisors before investment decisions.